How many times has the debt ceiling been raised

Are you curious about the intricate dance of fiscal policy and governmental finance? Dive into the world of economic maneuvering as we unravel the mystery behind a crucial question: How many times has the debt ceiling been raised? In this FAQ guide, we navigate the historical milestones, examine the reasons behind these adjustments, and shed light on the implications for both the nation and its citizens. Get ready for a journey through financial history, where numbers tell stories and policy decisions shape the economic landscape.

Contents

How many times has Congress raised the debt ceiling?

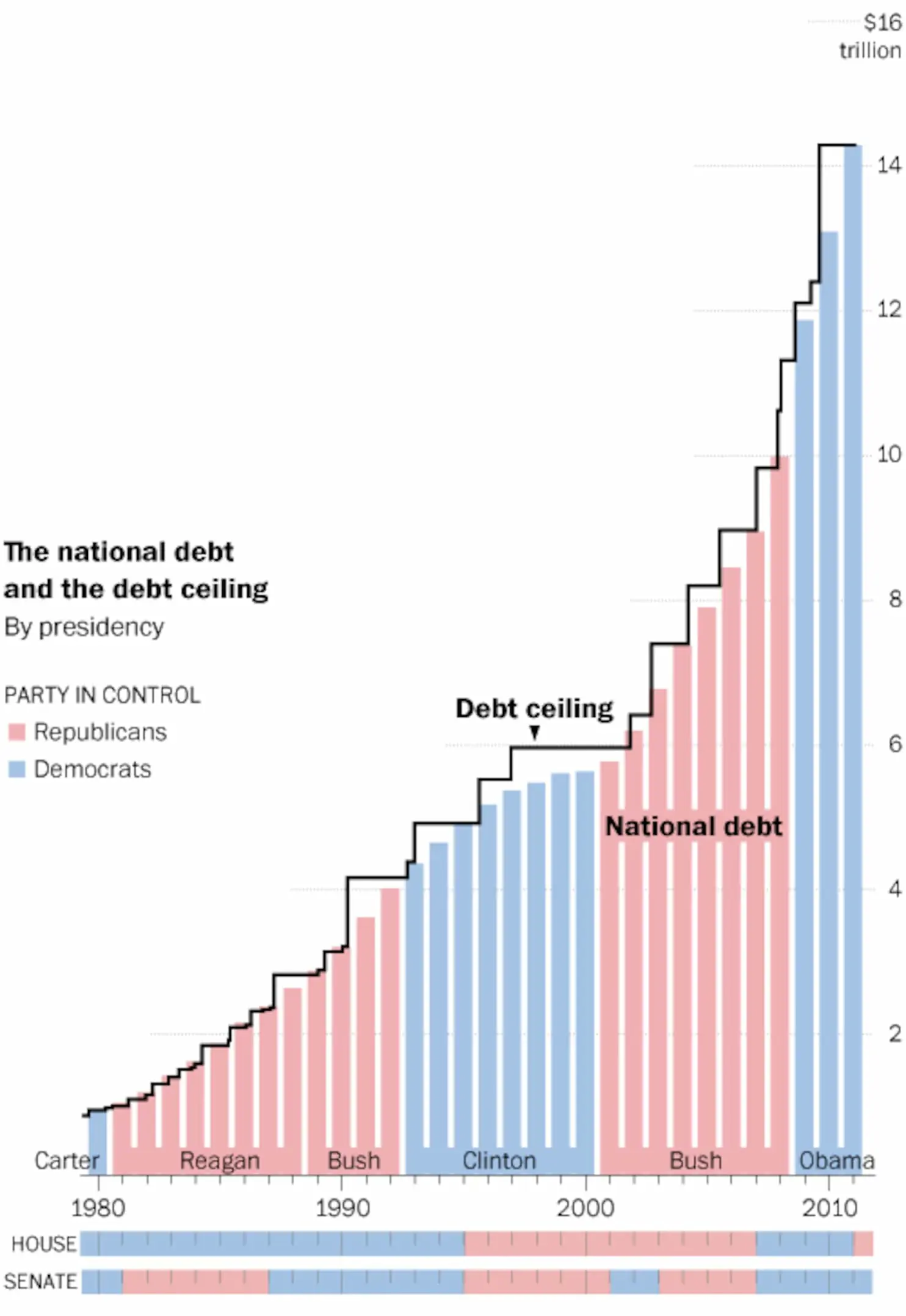

Curious about the history of debt ceiling adjustments? Congress has raised the debt ceiling 14 times between 2001 and 2016. During President Bush’s eight-year term, the debt ceiling saw 7 increments, resulting in a total increase of $5,365 billion. President Obama’s tenure witnessed 11 debt ceiling raises, with a cumulative increase of $6,498 billion as of March 2015. Explore the timeline and financial nuances of these crucial decisions in the table below:

| Year | President | Number of Raises | Total Increase (in billion $) |

|---|---|---|---|

| 2001-2008 | Bush | 7 | $5,365 |

| 2009-2016 | Obama | 11 (as of 03/2015) | $6,498 |

This succinct overview provides insights into the frequency and scale of debt ceiling adjustments, offering a snapshot of the economic decisions that have shaped the nation’s financial landscape.

What happened to the US debt ceiling during George W Bush’s term?

Delve into the fiscal landscape of President George W. Bush’s two terms, witnessing a significant transformation in the US debt ceiling. Commencing at $5.95 trillion at the beginning of his presidency, the debt limit underwent a series of seven increments, nearly doubling to a final value of $11.315 trillion. The table below summarizes the key milestones:

| Starting Debt Ceiling | Number of Raises | Final Debt Ceiling |

|---|---|---|

| $5.95 trillion | 7 | $11.315 trillion |

Discover how the debt ceiling evolved during this period, reflecting the economic decisions that shaped the nation’s financial course.

What would happen if the US defaulted on the debt ceiling?

The consequences of a US default on the debt ceiling extend far beyond national borders, potentially triggering a collapse of the entire international financial system. The ripple effect could lead to catastrophic impacts on the global gross domestic product (GDP) and widespread unemployment. Remarkably, the United States has yet to undergo a default, having raised the debt ceiling 78 times since 1917. As of now, the debt ceiling stands at a staggering US$31.4 trillion, showcasing the nation’s ongoing efforts to navigate the complexities of fiscal responsibility.

What was the debt ceiling under Trump?

Explore the dynamics of the debt ceiling during President Donald Trump’s tenure. The debt ceiling underwent two increases during his administration, accompanied by strategic adjustments to both the budget and debt ceiling policies. As Trump assumed office in January 2017, the national debt was recorded at $19.9 trillion. Delve into the intricacies of fiscal decisions during this period, highlighting the nuanced approach taken to address the nation’s economic challenges.

When was the last time America was debt free?

Experience a historical anomaly as we journey back to the early years of the United States. In a unique occurrence, the nation achieved debt-free status for the first and only time at the outset of 1835, maintaining this state until 1837. This remarkable period marks the sole instance in history when a major country successfully eliminated its debt. Dive into the motivations behind this feat, as President Jackson and his followers considered freedom from debt a crucial foundation for establishing a truly free republic.

Why does the US have so much debt?

Uncover the reasons behind the substantial debt burden carried by the United States. The federal government resorts to borrowing when its expenditures and investments surpass the available revenues, necessitating external funding. Key factors contributing to this scenario include decreases in federal revenue, often stemming from either reduced tax rates or diminished income for individuals and corporations. This interplay of fiscal dynamics sheds light on the complexities driving the accumulation of national debt.

Did the US default on debt in 2011?

Delve into a pivotal moment in U.S. fiscal history on July 31, 2011. President Obama declared a significant achievement as leaders from both political parties in both chambers reached an agreement. This milestone not only aimed to reduce the deficit but, crucially, averted the looming threat of default. Explore the details of this agreement and its impact on the nation’s financial stability during a critical juncture.

What is Canada’s debt ceiling?

Navigate the financial landscape of Canada as we explore the intricacies of its debt ceiling. Governed by the Financial Administration Act, the Finance Minister is obligated to adhere to a borrowing ceiling, currently set at $1.168 trillion. This ceiling encompasses amounts borrowed by Crown corporations, as well as Canada’s mortgage bonds guaranteed by the Canada Mortgage and Housing Corporation. Uncover the regulatory framework shaping Canada’s fiscal responsibility and the mechanisms in place to manage its national debt.

Which country owns most of U.S. debt?

Uncover the dynamics of foreign holdings in U.S. debt, with Japan taking the lead as the top holder. Boasting $1.1 trillion in Treasury holdings, Japan surpassed China in 2019. Notably, China reduced its holdings by over $250 billion, constituting a 30% decrease in just four years. Dive into the shifting landscape of international investments and explore the implications of Japan’s significant position in holding U.S. debt.

How much does China owe the US?

Delve into the intricate web of international debt as we explore China’s financial ties with the United States. The U.S. pays interest on about $850 billion of debt held by the People’s Republic of China. However, a noteworthy twist emerges, as China finds itself in default on its sovereign debt held by American bondholders. Uncover the nuances of this economic relationship and the implications for both nations.

What country has the least debt?

Explore a list of countries showcasing the lowest national debt percentages, reflecting their fiscal responsibility:

- Brunei: 3.2%

- Afghanistan: 7.8%

- Kuwait: 11.5%

- Democratic Republic of Congo: 15.2%

- Eswatini: 15.5%

- Palestine: 16.4%

- Russia: 17.8%

Dive into the economic landscape of these nations and understand the factors contributing to their relatively low levels of national debt.

Reflecting on Fiscal Evolution

In unraveling the historical tapestry of how many times the debt ceiling has been raised, we’ve embarked on a journey through pivotal moments in U.S. fiscal policy. From the early 20th century to the present day, the debt ceiling has been a crucial tool in navigating economic challenges and financing government operations.

The numbers tell a story of the nation’s response to evolving financial landscapes, with each increase reflecting the complex interplay of political, economic, and global factors. From the unprecedented events of the early 1830s to the modern era of trillion-dollar increments, the debt ceiling stands as a testament to the dynamic nature of economic governance.

As we reflect on the intricacies of these adjustments, it becomes evident that the story of the debt ceiling is not just about numbers; it’s about the resilience and adaptability of a nation in the face of economic uncertainties. The ongoing dialogue surrounding the debt ceiling serves as a reminder of the delicate balance required to sustain a stable and thriving economy.

In the ever-changing landscape of fiscal responsibility, understanding the history and implications of debt ceiling raises empowers us to navigate the complexities of economic governance with informed perspectives. The journey continues, and the debt ceiling remains a crucial element in shaping the economic destiny of the United States.